When Is the Best Month to Rent a House

What is the best time of yr to rent an flat? Conventional wisdom would suggest that apartment hunting during the wintertime is superior to hunting during the summer. Get-go, new graduates (or current students) tend to move during the summertime, prior to commencing piece of work or school. These new graduates would then be stuck on a summertime cycle, since typical leases are for 1 or two-year terms. Second, fewer people opt to search during the colder, holiday months of the winter. Finally, unexpected vacancies, such as job changes, family emergencies, or evictions happen year-circular and don't have as large of an touch on seasonality. These imbalances cause strong seasonality patterns in rentals.

But is that always the case across the US? What is the verbal impact and how strong is the consequence? To respond these questions, we do a deeper dive into rental trends across the country. Specifically, we look at the meridian 10 cities (based on their metropolitan statistical area population) to find the best and worst times to rent.

We wrote our original piece last year, but we've since updated our data (to include 2022 and Q1 2019). Even though we've updated some of our methodology, the results are largely the aforementioned.

We find that:

- Acme-to-trough (well-nigh expensive month versus least expensive month) differences are betweenii.0% to 4.seven% for one-bedroom apartments andone.6% to 7.1% for ii-bedroom apartments across the top ten metropolitan areas. The dollar savings (depending on city and apartment size) can be anywhere between$38 and $139 per month (for 1-bedroom apartments) and$47 and $176 for 2-bedroom apartments.

- The "best" or cheapest months to rent tended to exist between Dec and March (early on winter to early spring) across the 10 cities.

- The "worst" or well-nigh expensive months across all the metros are in the May through Oct (basically early on summer to early fall).

- New York had the largest one-bedroom seasonality (four.vii%) whereas Chicago had the highest 2-bedroom seasonality (7.1%).

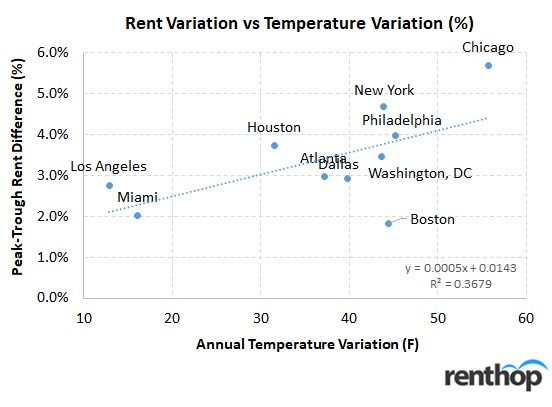

- The theory that wintry conditions is keeping people abroad might have some merit. We find a correlation of 0.61 between meridian-to-trough temperature variations in a city and peak-trough rental price variations (boilerplate of 1 and 2 bedrooms).

- Nevertheless, college enrollment as a percentage of metro population doesn't seem to have much of an impact on rent variation. The correlation is even a slight negative at -0.23. Notwithstanding, the 5 cities with highest enrolled student percentage had an average seasonal variation of iii.7% vs three.0% for the v cities with everyman pupil percentage.

What's the best time of year to hire?

In general, rents tended to be lower during the wintertime. The "best" months to hire are betwixt Dec and March (during the winter). Conversely, the "worst" months are between May and October (during the summertime). This relationship held for all cities that we looked at (and for both 1 and 2-bedroom flat units), regardless of region. On boilerplate, we come across around a 3.4% "discount" between cheaper months and height months. Methodology notes at the bottom.

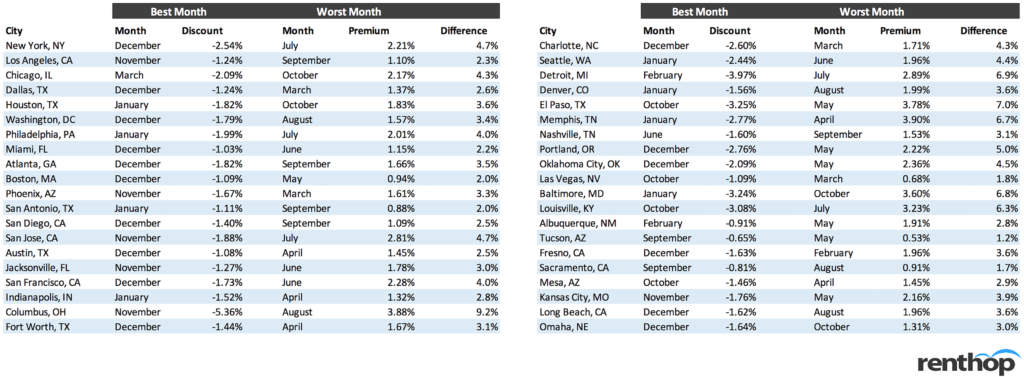

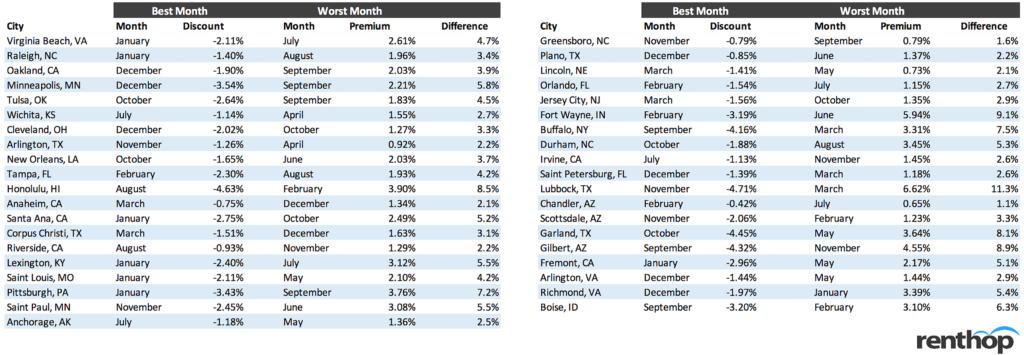

Below, we show the best and worst months for each city (as well equally the summit-to-trough discounts). Note that we used an gauge 2022 median pricing for i and 2-bedchamber apartments (rounded to the nearest $100) to put the seasonality into dollar terms (not the current snapshot of rental prices).

Overall, the peak-to-trough differences are betwixt 2.0% to iv.vii% for 1-chamber apartments and 1.six% to 7.one% for two-sleeping accommodation apartments across the top 10 cities. In addition, there doesn't seem to be much of a departure in seasonal variability between 1-bedrooms and 2-bedrooms (boilerplate seasonal variation of 2-bedrooms is simply around 0.1% more than 1-bedrooms) across cities. We as well notice that in nigh cities, December happens to be the cheapest month, while September tends to be the most expensive.

Fifty-fifty though 2-v% might seem small, the total annual savings can exist significant. In New York for example, 1-chamber units were roughly $139/month cheaper (or $1,668 annually) in December versus July. two-bedchamber apartments were $176/calendar month cheaper (or $2,112 annually).

Plain, dollar savings will be smaller in cities where the price of living is cheaper. The Texas cities, for example, are effectually 2x cheaper than New York or Boston (so the dollar savings are also much smaller). However, $600-$800 dollars in savings over a 12-month lease is zippo to scoff at. Given the opportunity, renters should opt to cease their leases near the wintertime (or at least exist wary of non-standard lease terms that might push button them off a good cycle). They should also be wary of any discounts from "months gratis" type concessions which won't stick around for the next renewal. Note, though, that nosotros're not because the potentially lower choice during the winter months. Generally, college turnover means more possible apartments (though they'll likely get swooped up faster!). Next, nosotros expect at a city by metropolis basis.

A City past Urban center Expect

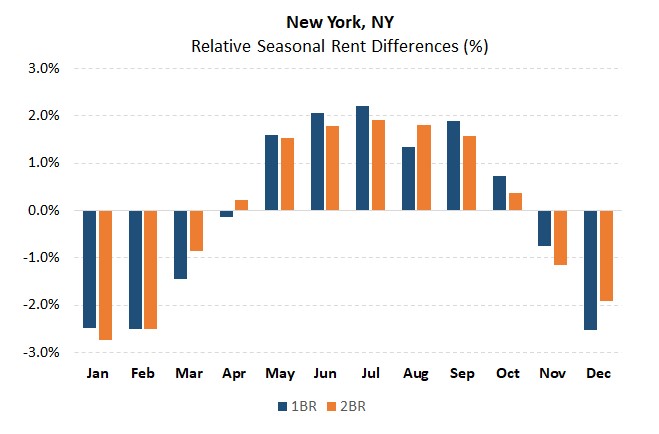

New York, NY

We first look at apartments in New York, arguably the largest and diverse rental market. Not only is New York filled with out-of-town enrolled university students, but it's also a major hub for new graduates. Every year, tens of thousands of new graduates flock to the city to commencement their new jobs. Being in the northeast, New York is also subject to high seasonal temperature variation (at least relative to the West or South).

Rental prices offset to increment in early May and peak around June/July/August. Rents beginning to taper again starting in October (before reaching a low in Feb). Interestingly, the lower-cost periods and higher-toll periods last for a while, and seasonal price flips happen chop-chop (over a bridge of only 1-two months).

In NYC, you're looking at roughly four.seven% and iv.vii% top-to-trough seasonal differences for 1 and 2-bedroom units, respectively. Assuming a 1-sleeping accommodation costs $2.8K, that equates to effectually $139 in savings monthly between superlative months and depression months. Assuming a two-bedroom costs $3.6K, that equates to around $176 in savings monthly.

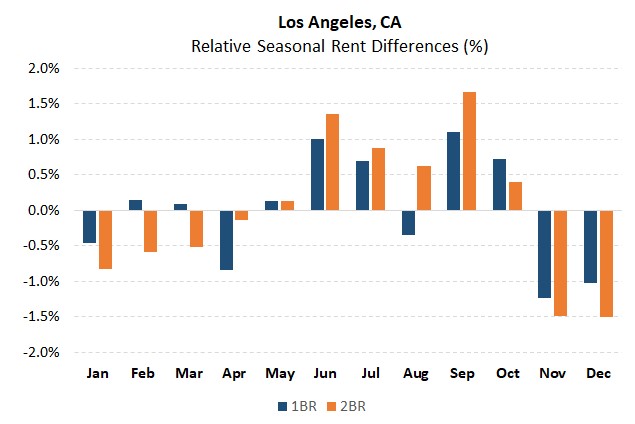

Los Angeles, CA

The Los Angeles seasonal chart is a bit messier than the New York 1. In fact, while there appears to be price increases during the summertime (between May and September) they are mostly milder than the ones we saw above (for New York). The slower season, though, abruptly starts around November/Dec.

In LA, you're looking at roughly 2.3% and iii.2% acme-to-trough seasonal differences for 1 and 2-sleeping accommodation units, respectively. Bold a 1-chamber costs $2.4K, that equates to around $58 in savings monthly betwixt peak months and low months. Bold a 2-bedroom costs $3K, that equates to around $98 in savings monthly.

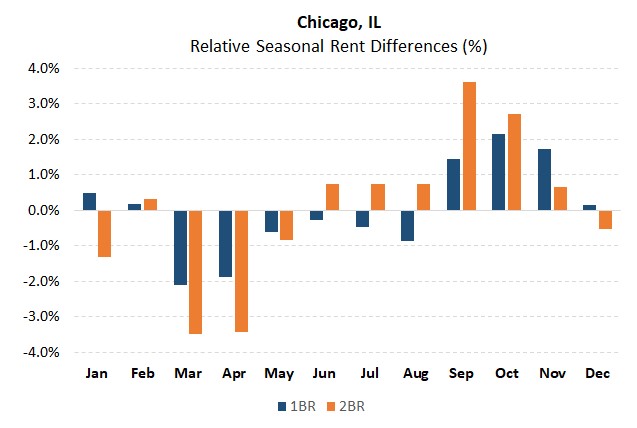

Chicago, IL

Moving on to Chicago, we see that the seasonal rental pattern is smoother than that of New York (less abrupt seasonal changes). In addition, we run across that two-bedrooms announced to exist more than impacted by the seasonality effect than 1-bedroom apartments. Prices appear to top around September/Oct and trough effectually March and April (slightly shifted from LA and New York). The dreaded Chicago winter might impact this (since the cold weather might linger a flake longer).

In Chicago, you're looking at roughly 4.3% and 7.ane% peak-to-trough seasonal differences for 1 and 2-sleeping room units, respectively. Bold a one-sleeping room costs $1.8K, that equates to around $fourscore in savings monthly between acme months and depression months. Bold a 2-bedroom costs $2.3K, that equates to around $176 in savings monthly.

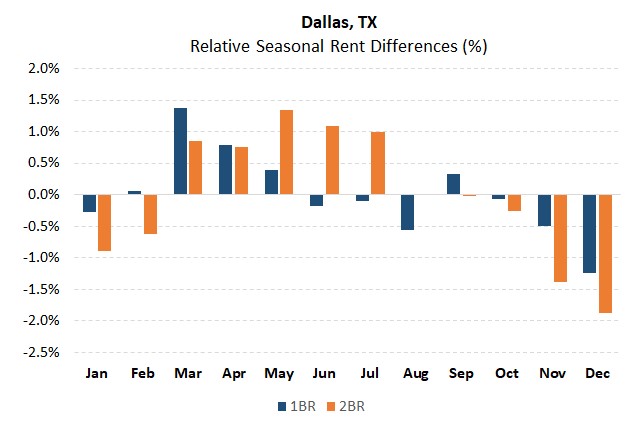

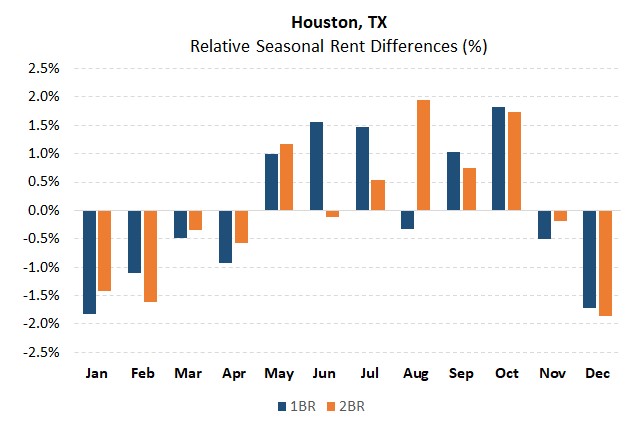

Dallas, TX and Houston, TX

We've lumped Dallas and Houston together because they're the just two top-10 metros that are in the same state (ranked 4th and fifth by population size!). For both Dallas and Houston, we encounter that the slow flavor tends to be between November and February. In Dallas, the peak season starts around March (lasting through Baronial). In Houston, the high season kicks off in May before peaking in August.

In Dallas, yous're looking at roughly two.6% and 3.2% elevation-to-trough seasonal differences for 1 and 2-bedroom units, respectively. Bold a ane-bedroom costs $1.4K, that equates to around $38 in savings monthly between meridian months and depression months. Assuming a 2-bedroom costs $1.8K, that equates to around $60 in savings monthly.

In Houston, you're looking at roughly 3.6% and 3.8% peak-to-trough seasonal differences for ane and 2-bedchamber units, respectively. Assuming a 1-sleeping room costs $ane.3K, that equates to effectually $49 in savings monthly betwixt peak months and depression months. Assuming a 2-bedroom costs $1.6K, that equates to effectually $63 in savings monthly.

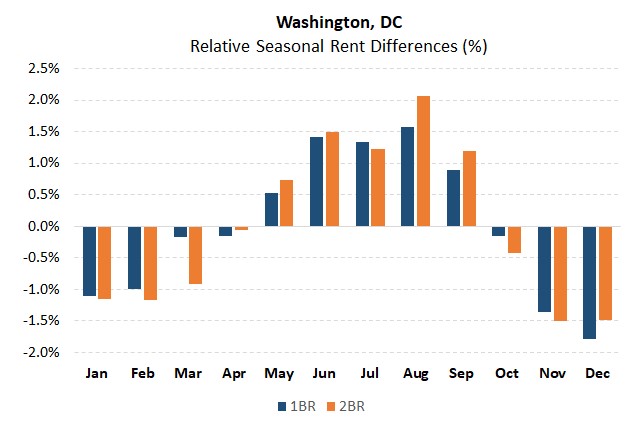

Washington, DC

DC exhibits seasonality patterns similar the other north-eastern cities. Specifically, we see that request prices kickoff to increase betwixt April and May, peaking in June. The slower season starts correct after September (with a low in Nov). For those currently looking for apartments, Jan and February are notwithstanding in the cheaper period of the twelvemonth.

In DC, you lot're looking at roughly three.4% and 3.6% top-to-trough seasonal differences for i and two-bedroom units, respectively. Assuming a i-bedchamber costs $2.2K, that equates to effectually $76 in savings monthly between tiptop months and low months. Assuming a 2-bedroom costs $three.1K, that equates to around $114 in savings monthly.

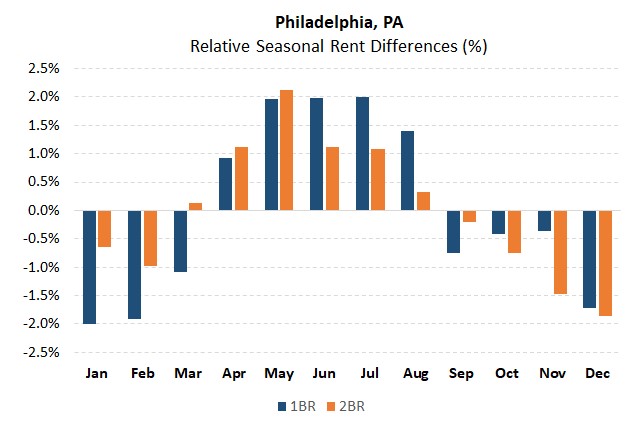

Philadelphia, PA

The hot menstruum for Philadelphia rentals seems to exist a month shorter than some of the other cities nosotros've looked at. The peak season seems to option upwards in March earlier peaking in May. The slower flavor seems to first in September/October (though these two months might be considered neutral). The trough in rental prices starts betwixt November and December.

In Philadelphia, you're looking at roughly 4.0% and 4.0% peak-to-trough seasonal differences for 1 and two-bedchamber units, respectively. Assuming a i-bedroom costs $one.6K, that equates to around $67 in savings monthly between height months and low months. Assuming a 2-bedroom costs $2.0K, that equates to around $83 in savings monthly.

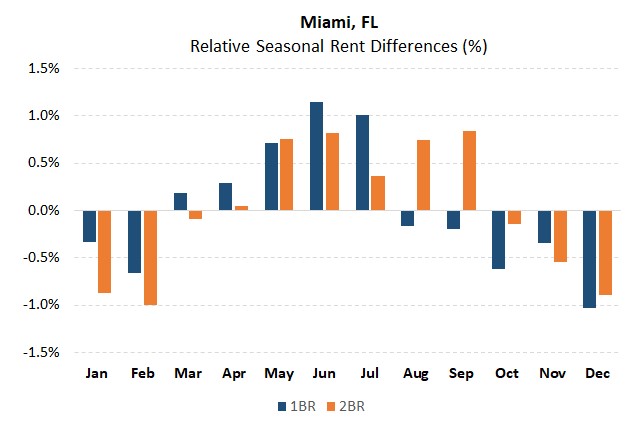

Miami, FL

In general, the seasonal fluctuations in the Miami rental market appear to be less pronounced than that of the northern cities. Rents seem to peak in June (with a high season running between May and September). Around October through February, rents drop slightly.

In Miami, you're looking at roughly 2.2% and 1.8% superlative-to-trough seasonal differences for 1 and two-bedroom units, respectively. Assuming a 1-chamber costs $2.0K, that equates to around $45 in savings monthly between peak months and low months. Assuming a 2-bedchamber costs $two.6K, that equates to around $49 in savings monthly.

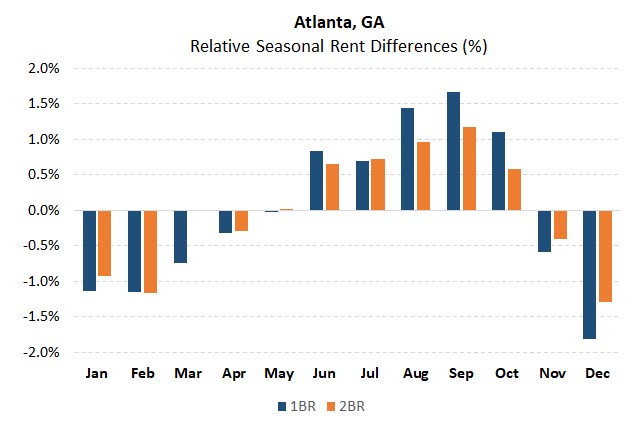

Atlanta, GA

Similar Miami, Atlanta's seasonal rental variations are less pronounced than those of the n-eastern cities (at least for two-bedroom apartments). The high flavour for both one and 2-bedchamber apartments ramps upwards in May before peaking in September. This high flavor doesn't end until Nov (with a brusk iv-month lower-rent period).

In Atlanta, you're looking at roughly 3.five% and 2.v% summit-to-trough seasonal differences for 1 and 2-bedroom units, respectively. Assuming a 1-bedroom costs $i.6K, that equates to around $58 in savings monthly between peak months and low months. Assuming a 2-bedroom costs $2.2K, that equates to effectually $56 in savings monthly.

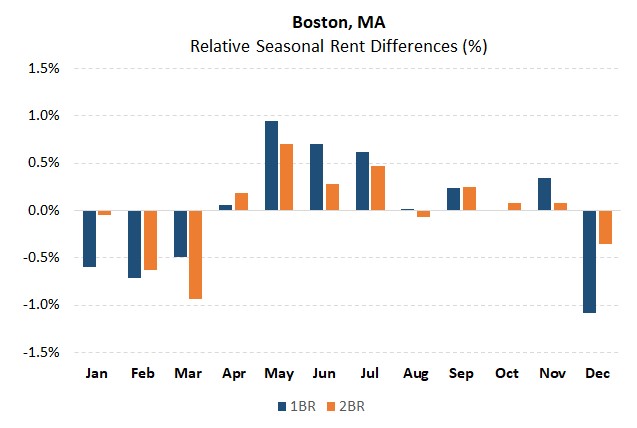

Boston, MA

Finally, we await at Boston, MA (excluding Cambridge, MA). Rents in Boston offset ramping around April. The irksome flavor begins in Dec and ends around April.

In Boston, you lot're looking at roughly two.0% and i.half dozen% summit-to-trough seasonal differences for one and 2-bedroom units, respectively. Assuming a 1-sleeping accommodation costs $2.3K, that equates to around $48 in savings monthly between peak months and depression months. Assuming a ii-bedroom costs $ii.8K, that equates to effectually $47 in savings monthly.

Possible Causes

No seasonality study would be complete without exploring possible causes. We accept a rough await at two possibilities: Weather and student populations. Note though, that in that location are likely stronger drivers of seasonal pricing than just these two. For both these possibilities, we'll be using the average of the 1 and ii-bedroom peak-to-trough rental price changes (which we telephone call the "Rent Variation"). Doing so allows us to incorporate the two data points for each city.

First, are temperature variations keeping people abroad from looking for an apartment? Specifically, practice superlative-to-trough temperatures impact peak-to-trough rents? To answer this query, we looked at boilerplate monthly temperatures for each of the major cities.

Some parts of the country (like Los Angeles and Miami) take very mild weather changes throughout the yr, with average monthly temperatures ranging past only 12-16 degrees (F). Other parts, though have wild variations. Everyone has heard of the dreaded Chicago winter… and for good reason! Chicago's monthly temperatures vary by a whopping 55 degrees (F).

So how well does this explanation hold up? It turns out that in that location is amoderate correlation (0.61) between temperature variations and rent variations.

If we run a elementary regression, nosotros find an R^two of 0.37 (with every x degrees of temperature increasing the seasonal variation by 0.5%). Of course, this figure should exist taken with a grain of salt. The rental index data is itself volatile. In improver, we're only working with only 10 data points. However, this shows that temperature variations could have an impact (with cold weather keeping some people from going out and looking for their new homes).

Adjacent, we test the "Student population" theory. Does the ebb and menstruation of seasonal students bear upon how the rental marketplace plays out? Nearly people living in Boston are familiar with the September moving season. Certainly, September seems to coincide with the peak in prices for many of the cities. But do these college students explicate price variations?

Even though we don't have proficient data on the number of enrolled students, we rely on the data-table from CityLab scaled by 2022 metro populations. In addition, we assume that Atlanta has enrolled student/population ratio of effectually 3.6%.

Here, we find a depression negative 0.23 correlation between student population % and seasonal variation. However, the 5 lower enrollment cities have an average of 3% variation vs 3.8% variation for the college enrollment cities. As a upshot, the explanation doesn't actually hold h2o.

While temperature seem to explicate somewhat the monthly variations across the cities, they're certainly not comprehensive. The brand-up of local inventory (student only inventory – for example), movement of new graduates, and a plethora of other factors could be larger drivers of rental seasonality.

Conclusion

In general, we see that seasonal variation across the ten largest metro-areas to be in the ane.6 to vii.1% range (for both ane and 2-bedrooms). Ultimately, renters who can get on the "wintertime" lease renewals schedule should try for it. In improver, renters should be wary of non-standard charter-terms (basically lease terms greater than one year) that might push button them from a winter schedule into a summertime / early bound i. They should too exist wary of any discounts from "months gratis" type concessions which won't stick around for the next renewal. Finally, there might ultimately be a merchandise-off between cheaper rents versus potentially larger choice that renters should be cognizant of.

Methodology Notes

To avoid problems with shifting inventory inside each rental market, we don't use the simple median price beyond markets. We summate prices (based on apartment characteristics) in tight geographic zones and apply fixed weights (based on inventory %) beyond these zones over time. In addition, though we're focusing on the top x metro areas, we're using data from the "city" (non the MSA itself). Outlier changes are removed.

We used prices "net" of whatsoever concessions that might exist offered by landlords. Even with these adjustments, though, median pricing data is far from perfect. Seasonality factors were obtained by detrending the information using moving averages (data betwixt 2011 – 2019Q1).

Note, for Boston, nosotros excluded the city of Cambridge when calculating this year'south information.

Addendum

As an addendum to our "Best Fourth dimension of Year to Rent" study, we've expanded the written report to include 79 additional cities (of the top 100 cities that we have information for). To keep information technology uniform (and to include the all-time information), we only looked at 1 BR units.

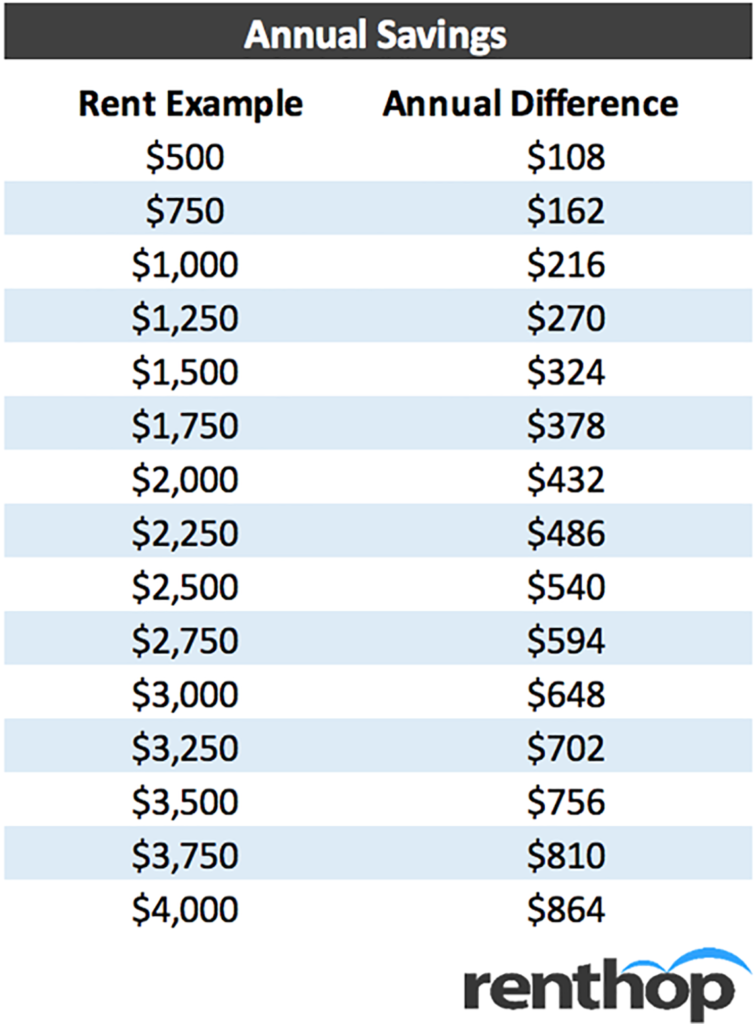

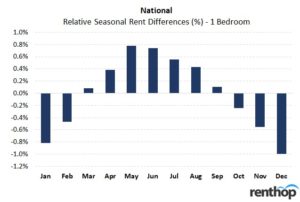

Nationally overall, we observe that indeed, the winter months tend to feature lower prices than the summer ones. On average, December tends to exist the best month to start a lease and May tends to be the worst (1% disbelieve vs. 0.eight% premium). Run across below for a table that shows the potential almanac savings if renting an apartment in May, when the peak-to-trough divergence for a i-bedroom apartment is 1.8%, and a bar chart that shows the national relative seasonal rent differences for a 1-bedroom flat.

Note: Even though nosotros excluded cities with insufficient data, and nosotros cleaned upwardly outliers, data in smaller cities may non exist perfect. Yet, the full general seasonality tendency (winter months being cheaper) seems to hold across the nation.

See the table below for a full list of cities with their all-time and worst months

Methodology Notes (Expanded)

We included 79 cities out of the meridian 100 cities (by population). 21 cities were excluded because we did not have at least 4 years of data (which was minimum to be included). Most of the data begins in January 2012. However, a few cities had less data (beginning January 2014. Nosotros but looked at ane-chamber units (considering of data availability).

To avoid problems with shifting inventory inside each rental market, we don't employ the elementary median price across markets. We calculate prices (based on apartment characteristics) in tight geographic zones and utilize fixed weights (based on inventory %) beyond these zones over fourth dimension.

We used prices "net" of any concessions that might exist offered by landlords. Even with these adjustments, though, median pricing information is far from perfect. Seasonality factors were obtained by detrending the data using moving averages.

The national "overall" summary was washed by taking a elementary boilerplate of the monthly discounts/premiums across the 79 cities (i.e., each metropolis is every bit weighted).

Source: https://www.renthop.com/studies/national/best-time-of-year-to-rent

0 Response to "When Is the Best Month to Rent a House"

Post a Comment